In recent times, the onsite C&I market has struggled with high transaction costs and financing limitations, which has seen a significant shift occur towards offsite utility scale solar corporate deals. Next year, according to Green Tech Media (GTM), off-site deals are projected to become the largest source of business-led solar procurement in the United States.

There’s been a huge amount of growth in utility scale solar applications for large companies, as they’re starting to see the benefit of large solar projects purchased through leases, which is causing the market to realign.

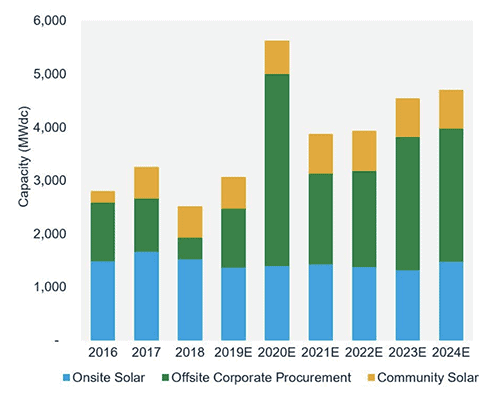

GTM projects procurement from offsite solar power-purchase agreements will remain the largest source of business-led solar procurement through 2024, while onsite commercial and industrial solar will stay relatively flat.

Utility Scale Solar Growth

Corporate offtakers are set to drive solar market growth over the next two years, with the U.S. solar market expected to grow 17% this year and 39% in 2021. With the solar industry taking off, there are three main segments that fulfill the C&I market; Larger utility-scale solar, community solar and smaller behind-the-meter distributed solar.

So far, many companies have opted for onsite solar as it delivers higher returns and takes advantage of underutilized roof space. Around 70% of cumulative C&I solar installations to date are onsite. However, there are some key issues with the onsite C&I market, namely high transaction costs and financing limitations. Although the onsite market peaked in annual deployments in 2017, at under 2,000 megawatts, it isn’t expected to come close to that again within the next 5 years.

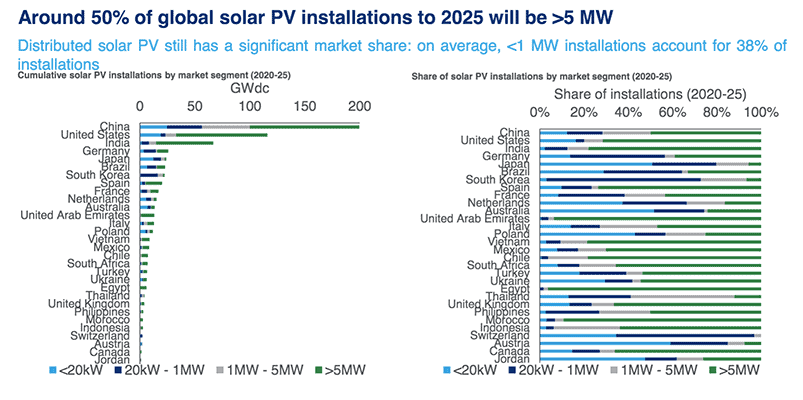

In contrast, demand for offsite C&I utility scale solar is increasing. Wood Mackenzie released a report at their 2020 Solar Summit that outlined the trajectory of installations from now-2025. Around 50% of global solar PV installations will be greater than 5 megawatts, which calls for offsite projects to cater to the size of demand.

The diagram below also shows the significant increase in offsite corporate procurement and subsequent drop in onsite solar by 2024.

A Change in Players

As recently as this year, the top five offsite solar developers monopolized 49% of the market, however, more and more developers are entering the space and experimenting with business development strategies. Newer players are working to establish themselves by snaring large offsite C&I pipelines from the developers with the most megawatts already deployed.

Data firms are the front runners for offsite C&I solar, as they take advantage of utility-scale PPA rates with their concentrated electric loads from data centers.

Community solar projects are also on the rise as they mitigate risks attached to utility-scale PPAs. Community projects tend to have more diversified interests, encompassing onsite, distributed solar and offsite utility-scale solar.

There are many emerging community solar programs that are set to reshape large off-site solar utility by making it more accessible.

The New Landscape

According to GTM, the various segments of the C&I solar market will continue to make from 22% – 32% of the total U.S. solar market. Markets are being pushed to reach corporate sustainability goals and business and corporations are becoming increasingly aware of setting clean energy targets. These customers will inject capital into the sector as they reach out to companies like EnergyLink, to install large-scale utility solar for them.