Solar Renewable Energy Credits are a solar incentive that represents and rewards positive environmental impacts from generating clean solar energy. SRECs ensure that your electricity is coming from a solar and renewable energy source. Investing in SRECs will not only benefit your corporation financially and help reduce your carbon footprint, but will also benefit your community and the environment overall. Other benefits of SRECs and more information about what they are and how to invest in them are outlined below.

What are Solar Renewable Energy Credits?

Solar renewable energy credits or “certificates” are a solar incentive that allow you to earn additional income from solar electric generation. For every megawatt-hour (MWh) or 1,000 kilowatt hours of solar electricity generated by a solar panel system you can earn one SREC.

Utility companies are required to produce a specific percentage of their electricity from renewable resources, under state regulations called renewable portfolio standards (RPS) so they purchase renewable energy certificates (RECs). SRECs are a type of REC that proves a utility has either produced solar renewable electricity themselves or paid someone who has produced solar renewable electricity for the right to consider it their own.

RPS requirements sometimes demand that electricity suppliers obtain a certain amount of energy from solar energy systems. This is known as a solar carve-out. Solar carve-outs are a main driver of SREC markets.

How to invest in Solar Renewable Energy Credits

There are seven states with SREC programs and these are: New Jersey, Massachusetts, Pennsylvania, Maryland, Washington D.C., Delaware and Ohio. While some of these states, such as New Jersey, require that SRECs come from systems inside of their boarders, some allow SRECs to be purchased from out-of-state.

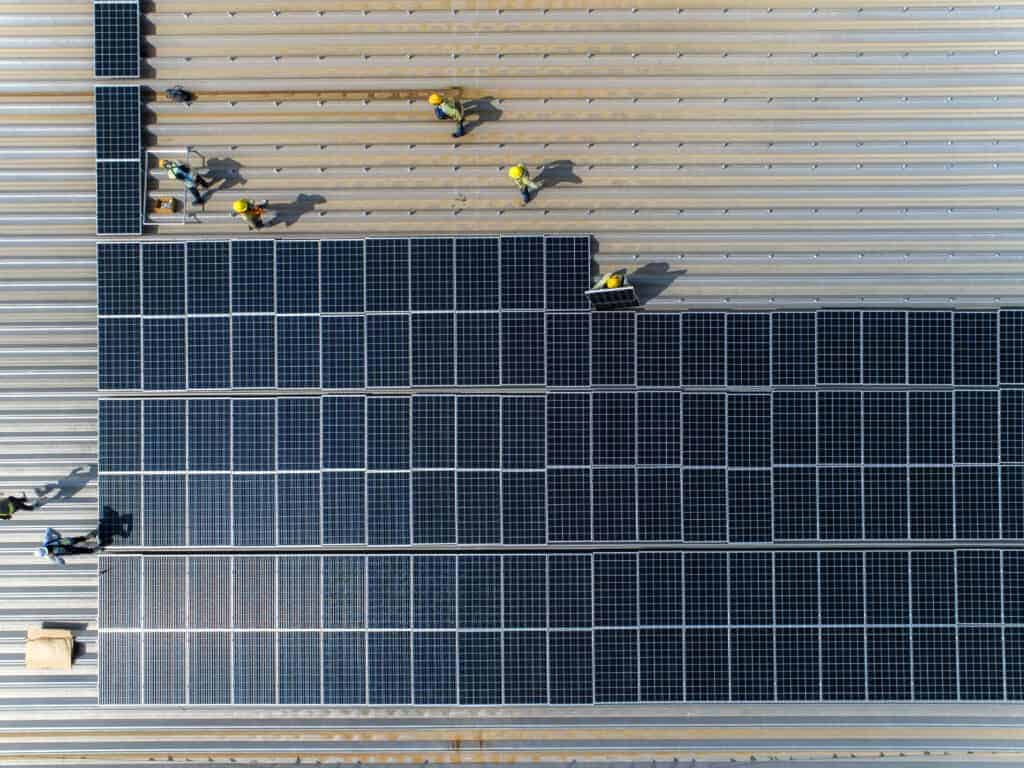

To get started, register your solar panels in order to track your SREC production. As your panels produce electricity, its monitored by the SREC tracking system. You can then sell your SREC either on your own or through a partnership with an aggregator. Utilities are more likely to buy from a SREC aggregator, however. An aggregator will sell your SRECs to utility companies for a small fee, allowing you to profit off the sale.

Benefits of investing in Solar Renewable Energy Credits

There are numerous benefits that come with investing in solar energy and solar renewable energy credits. Many of these benefits are financial. With SRECs, it becomes possible to see a faster and increased return on your solar system. Since SRECs are sold independently from electricity, you will still be eligible to receive net metering credits for excess energy production. Net metering allows you to profit off this excess energy by getting paid by your utility for sending it to the grid.

There are also environmental benefits that come with investing in solar technology and SRECs. Solar technology and SRECs will not only lower your corporations carbon footprint, but help to lower that of the utility company that you sell it to. It will increase overall sustainability in your community and the community that it is sold into. The combination of solar technology and SRECs will make a clear statement that your company values sustainability, and could attract likeminded individuals as potential employees or customers.

Interested in installing solar technology?

Installing solar technology and taking advantage of SRECs will positively impact both your corporation and community. EnergyLink has a team of experts prepared to take the lead on the designing, building and funding processes that will bring your solar energy project to life. Click the link below to get a free quote or call (866) 218-0380 to speak with an expert.