Solar energy has gained immense popularity due to its numerous sustainable benefits alongside government incentives in the form of tax credits. With a growing global trend towards sustainable energy, governments have started and increased tax incentives for renewable energy adoption. To promote the adoption of solar energy, governments provide tax incentives in the form of credits. This comprehensive guide will explore the tax credits available for solar energy projects, eligibility criteria, claiming procedures, and the benefits tax credits offer.

Introduction to Solar Energy Tax Credits

Solar energy tax credits serve as financial incentives to promote the adoption of solar power systems. Tax credits are deductions applied directly to the amount of tax owed, resulting in substantial savings for individuals and businesses. These credits can significantly offset the initial costs associated with installing solar panels, making renewable energy more accessible and affordable for individuals and businesses alike. By harnessing the power of the sun, solar energy projects contribute to a greener and more sustainable future while offering long-term economic benefits.

Federal Investment Tax Credit (ITC)

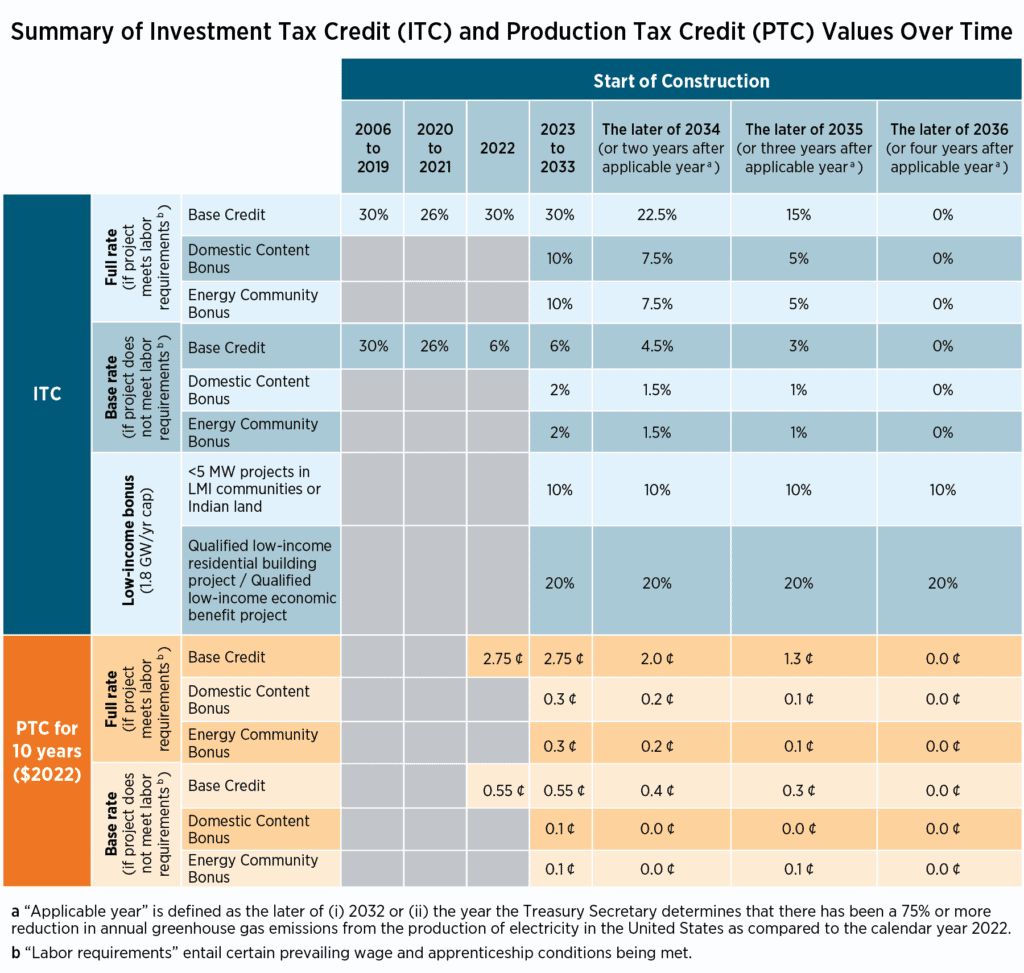

The Federal Investment Tax Credit (ITC) is one of the most substantial incentives available for solar energy projects in the United States. Under this program, eligible taxpayers can claim a percentage of their solar system’s cost as a tax credit. Currently, the ITC offers a 30% credit for commercial, governmental and non-profit solar projects that are placed in service in 2022 or later and begin construction before 2033, according to the Department of Energy. It is important to note that this credit is set to gradually decrease in subsequent years, making it even more advantageous to invest in solar energy sooner rather than later. See the chart below for a further breakdown of the ITC and its changes over time:

Read: What the Investment Tax Credit Extension to Energy Storage Means for the Industry

Production Tax Credit (PTC)

In addition to the Federal ITC, the United States offers a Production Tax Credit (PTC) as another form of incentive. PTCs are specifically designed to encourage the production of renewable energy, including solar power. This additional financial benefit plays a crucial role in making solar energy more accessible and affordable.

Under the PTC program, solar energy project owners or entities can claim a tax credit based on the electricity generated by their systems. The credit amount is determined by the kilowatt-hours (kWh) of electricity produced. As of the Department of Energy’s latest information, the PTC for solar energy projects is 2.75 ¢/kWh. However, it’s important to note that the specific details and rates of the PTC program may vary, so it is advisable to consult with a tax professional or the IRS for the most up-to-date information.

The PTC is typically available for the first 10 years of a solar energy project’s operation. To claim the PTC, project owners must meet specific eligibility criteria, including commercial operation dates and certain efficiency and certification standards. Similarly to the ITC, it’s worth mentioning that the PTC is subject to phasing out gradually over time, with reduced rates for projects that commence construction after certain specified dates. For solar projects that started construction before the phase-out dates, the full PTC rate is maintained for the first four years of operation, followed by a phase-down schedule. This gradual reduction in the PTC emphasizes the importance of initiating solar energy projects as soon as possible to maximize the financial benefits.

State and Local Incentives

In addition to the federal ITC, many states and local jurisdictions provide their own tax credits and incentives to promote solar energy adoption. These programs vary widely in terms of eligibility criteria, credit amounts, and application processes. It is crucial for individuals and businesses to research and understand the specific incentives available in their respective regions. Consulting with local solar installers or reaching out to state energy offices can provide valuable insights into these state and local programs.

Some common state-level incentives include:

- State Tax Credits: Certain states provide tax credits that can be used to offset a portion of the solar installation costs. The availability and amount of these credits depend on the state and may have specific criteria for eligibility.

- Rebates and Grants: Some states offer rebates or grants to incentivize solar energy installations. These financial incentives can help offset the initial costs and make solar projects more financially viable.

- Property Tax Exemptions: In certain jurisdictions, solar energy systems are exempt from property taxes. This exemption can significantly reduce the overall cost of installing and owning a solar energy system.

- Solar Renewable Energy Certificates (SRECs): SRECs are tradable certificates that represent the environmental benefits of generating electricity from renewable sources. Certain states have established SREC programs where solar system owners can earn credits for their systems’ electricity and then sell those credits on the open market.

Read: 8 Hidden Costs of Commercial Solar Projects: Simplifying Project Financing

Commercial Solar Investment Tax Credit

Businesses looking to embrace solar energy can also take advantage of the Commercial Solar Investment Tax Credit. Under this program, commercial entities can claim a 30% tax credit for qualified solar projects. This credit applies to both the purchase and installation costs of solar energy systems. By harnessing the sun’s power, businesses can significantly reduce their reliance on traditional energy sources, leading to long-term cost savings and environmental sustainability.

Qualifying for Solar Energy Tax Credits

To qualify for solar energy tax credits, certain criteria must be met. Generally, the solar panels must be installed on residential or commercial properties owned by the entity claiming the credit. Additionally, the solar system must meet specific efficiency and certification standards set by the government or relevant authorities. It is advisable to consult with a certified solar installer or tax professional to ensure eligibility and compliance with all necessary requirements.

Maximizing Tax Credit Benefits

To maximize the benefits of solar energy tax credits, it is crucial to consider the following:

- Timeframe: The federal ITC is subject to scheduled reductions, making it advantageous to initiate solar projects sooner rather than later.

- System Size: The tax credit is calculated based on the cost of the solar system. Investing in larger systems can result in higher credits.

- Financing Options: Exploring financing options such as loans, leases, or power purchase agreements can help spread the cost of solar projects over time while still qualifying for tax credits.

- Documentation: Maintaining thorough documentation of all expenses, including invoices, contracts, and certifications, is vital for claiming tax credits accurately.

Read: Long-term Outlook on the Inflation Reduction Act: What Renewable Energy Incentives Can be Utilized?

Transitioning to solar energy offers numerous benefits, from reducing reliance on fossil fuels to long-term cost savings. By understanding and leveraging the available tax credits and incentives, individuals and businesses can make solar energy projects even more financially viable. The Federal Investment Tax Credit, alongside state and local incentives, provides substantial financial relief to offset the costs of solar installations. With a commitment to renewable energy, we can pave the way for a greener and more sustainable future.

Interested in maximizing tax credits for your solar project?

By taking advantage of the Federal Investment Tax Credit (ITC) and exploring state and local incentives, individuals and businesses can significantly reduce upfront costs and accelerate their return on investment. Seeking professional guidance is crucial to ensuring a smooth and successful transition throughout the project process, however. At EnergyLink, we offer a range of financial modeling and project funding services to aid and support your organization in the implementation of clean energy systems.

To get started, click here or speak to a member of our knowledgeable team by calling (866) 218-0380. Interested in staying up-to-date on the latest renewable energy industry news? Fill out the form below to sign up for our bi-weekly industry insights newsletter.