Overview of C-PACE Financing

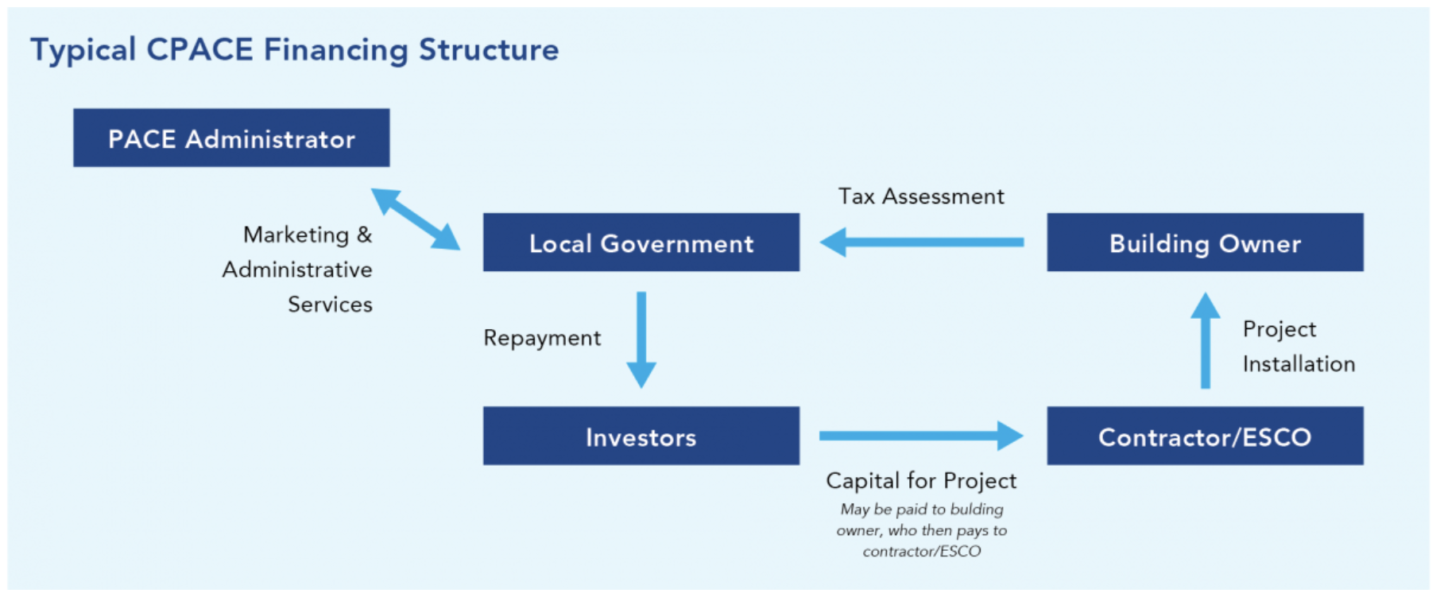

C-PACE stands for commercial property-assessed clean energy. It is a financing structure in which building owners borrow money from energy efficiency, renewable energy, or other projects and make repayments via an assessment on their property tax bill, according to the U.S. Department of Energy. The financing arrangement remains with the property even if it is sold, which promotes long-term investments in building performance, according to the U.S. Department of Energy.

Similar to other project financing methods, C-PACE borrows capital from C-PACE providers to pay for the construction costs and install energy efficiency or renewable energy improvements for the new energy system. C-PACE allows business owners to plan smartly with a flexible budget at the starting phase of constructing new energy systems and ensures enough capital to invest in the business development.

Who Handles C-PACE Agreement Terms?

The C-PACE developer will handle the agreement of financial terms and move on to auditing the facility, the engineering and design of the project and the construction. Most of the C-PACE developers in the market only handle the agreement and the business owners have to go to a contractor or energy services company (ESCO) to install the equipment.

There will be no upfront payment and after the installation of the project, business owners enjoy energy savings from day one. Then, every year, business owners will pay the C-PACE developer back in the form of property tax.

What’s more, C-PACE is not a federal program, and public funding is not necessary to run a C-PACE program. However, it must be authorized by state legislation and requires further authorization from local governments, according to the U.S. Department of Energy.

Advantages and Disadvantages of Using C-PACE Financing

C-PACE financing is a win-win program. It is good for the environment, for the development of the business, and helps the company stand out among its competitors.

According to the U.S. Department of Energy, some key advantages of C-PACE include:

- Positive cash flows: there are no upfront payments and business owners can make project payments with long, 10 to 20 year terms

- Strong security: lenders pay for the projects with property taxes, with better interest rates than other financing options

- Transferability: C-PACE projects are linked to the property instead of the property owners, so once the property is sold, the ownership of the C-PACE project automatically transfers to the new owner

- Overcomes the tenant/landlord split-incentive: C-PACE can align incentives for landlords and tenants by sharing the costs and savings

According to the U.S. Department of Energy, some key disadvantages of C-PACE include:

- Limited availability: C-PACE is limited to jurisdictions with PACE-enabling legislation

- Mortgage lender approval: if properties are under a mortgage, the mortgage lender has to consent before the project can move forward

- Limited to individual properties

What types of businesses are good candidate for C-PACE?

According to the U.S. Department of Energy, C-PACE is a good fit for the organizations that:

- Is located in jurisdiction with C-PACE programs

- Wants long-term financing (over 10 years) with longer monthly payments

- Wants to invest in long-term improvements to building resiliency and reliability

- Does not plan to own or occupy its facilities long-term

- Is interested in improving their organization’s sustainability

Current Situation of C-PACE

C-PACE is a fast-growing financing structure. According to PACENation, there are $893 million spent on a total number of 1866 C-PACE projects in 2017. 13,395 jobs have been created under C-PACE. The financing money C-PACE projects used nearly tripled from 2015 to 2017, according to PACENation.

Currently, there are more than 30 states have adopted C-PACE, including Missouri, Colorado, California etc.

EnergyLink is a certified C-PACE developer and it not only handles the agreement of financial terms with PACE, but also handles auditing your facility, the engineering and design work that goes with planning an energy project, and the construction phase of the project. If you are interested in C-PACE financing and want to find a reliable company to manage your C-PACE process, click here to contact our engineers to start the project.