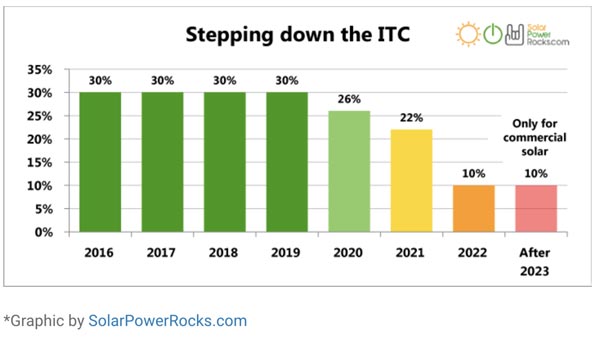

The Solar Investment Tax Credit is a huge financial benefit which makes commercial projects significantly more financial viable. However, after 2019, it was confirmed that the Solar Investment Tax Credit would be would gradually be decreased over a schedule of time; this is termed as a “sunsetting tax credit.” The chart below depicts the expected changes up to 2023.

Many organizations who are interested in solar have shown discontent in the fact that such a beneficial tax benefit to going with solar has been decreased, but it is a little known secret that the 26% solar ITC can still be taken advantage of after 2020 due to a special provision offered by the IRS called Safe Harbor.

Using Safe Harbor for the Solar Investment Tax Credit

The safe harbor provision allows you to reduce or eliminate legal or regulatory liability in certain situations as long as certain conditions are met. It’s worth noting that Safe Harbor is not exclusive to the solar investment tax credit; however, it is available, and it is the only way to secure the maximum 26% tax credit during the solar installation process in 2020 and beyond.

The IRS created the Safe Harbor program for commercial and utility solar projects which meet the conditions to qualify for the solar investment tax credit around the time it starts to decrease.

2 Ways to Get Safe Harbor

To qualify for the Safe Harbor program, a commercial solar project must meet one of the following conditions. Either 5% of the project cost must be incurred or physical work must begin in 2020. Regardless of which route is chosen to obtain the solar ITC using safe harbor, the project must be completed by 2023.

5% Project Cost Approach

This approach only requires that 5% of the cost of the commercial solar project be incurred in 2020 to secure the 26% tax credit. Many organizations feel this is the easiest way to lock in solar ITC rates because paying for a part of the project, such as materials, would allow for safe harbor qualification. So, with this in mind, solar contractors can just invoice for 5% of the project cost. Proof of payment will need to be provided to the IRS.

Physical Work Approach

One other way to secure the 26% solar ITC rate through safe harbor is to actually start construction of the commercial project in 2020. For this, proof will need to be provided to the IRS which shows that work did start at some point in 2020. Also, it is required that proof also be shown that work on the project happened continuously until the project is complete. This can be at any pace, and the project can be complete by as late as 2023.

The Case for Doing a Commercial Solar Project

EnergyLink has proven through various case studies that commercial solar projects can be extremely viable financially. Usually the arguments against doing a project are that budgets are not there for a project now, but the safe harbor rule is one which can be exploited if an organization knows they want to do a commercial solar project before 2023 but can’t come up with the funds right away.

Going this route makes it so your organization does not have to rush to get a project done; instead, you can get a project agreed and either started or partially paid for and be allowed plenty of time to allocate funds to the project. Given this, as well as the sustainable benefits of doing a project such as this, there’s no better time to do a commercial solar project than now.