Created in 2005, solar investment tax credit was part of the Energy Policy Act of 2005, according to Solar Energy Industries Association (SEIA). Signed in December 2015, the Consolidated Appropriations Act is an extension of the solar investment tax credit and it benefits a broader renewable energy category, according to the U.S. Department of Energy. The Consolidated Appropriations Act rebate taxes for renewable energy, including solar, fuel cells, small wind turbines, geothermal systems, microturbines, combined heat and power, and other production tax credit-eligible technologies.

What is the ITC?

ITC, or solar investment tax credit, is a “tax credit for 30% of the solar system cost,” according to Sun Valley Solar. Business owners can take it all in one year, or spread out over five years. For companies that installed solar energy systems, they are eligible for the 30% federal solar investment tax credit.

To be eligible for the ITC, you need to meet the following requirements:

- Have a tax liability

- Own the solar system–leased system doesn’t qualify

- Use solar energy to generate electricity, to heat, to cool or illuminate your facilities

Benefits you can get from the ITC included:

- Receive a 30% tax credit for solar systems on residential and commercial properties

- Shorten the time to achieve return on investment

How has the ITC influenced the solar growth?

According to Solar Energy Industries Association (SEIA), “the ITC is one of the most important federal policy mechanism to support the deployment of solar energy in the U.S.”

What’s more, there is 59% compound annual solar growth since the ITC was enacted in 2005. The installation of solar energy is expected to be more than 100 gigawatts by the end of 2022. At the same time, the ITC has been spurring roughly $140 billion in economic activity.

The success of the ITC encouraged the federal government to expand the policy, which comes to be as the Consolidated Appropriations Act in 2015. It also demonstrates that “stable, long-term federal tax incentives can drive economic growth while reducing prices and creating jobs in one of America’s fastest-growing industries,” according to SEIA.

What does the ITC look like after 2019?

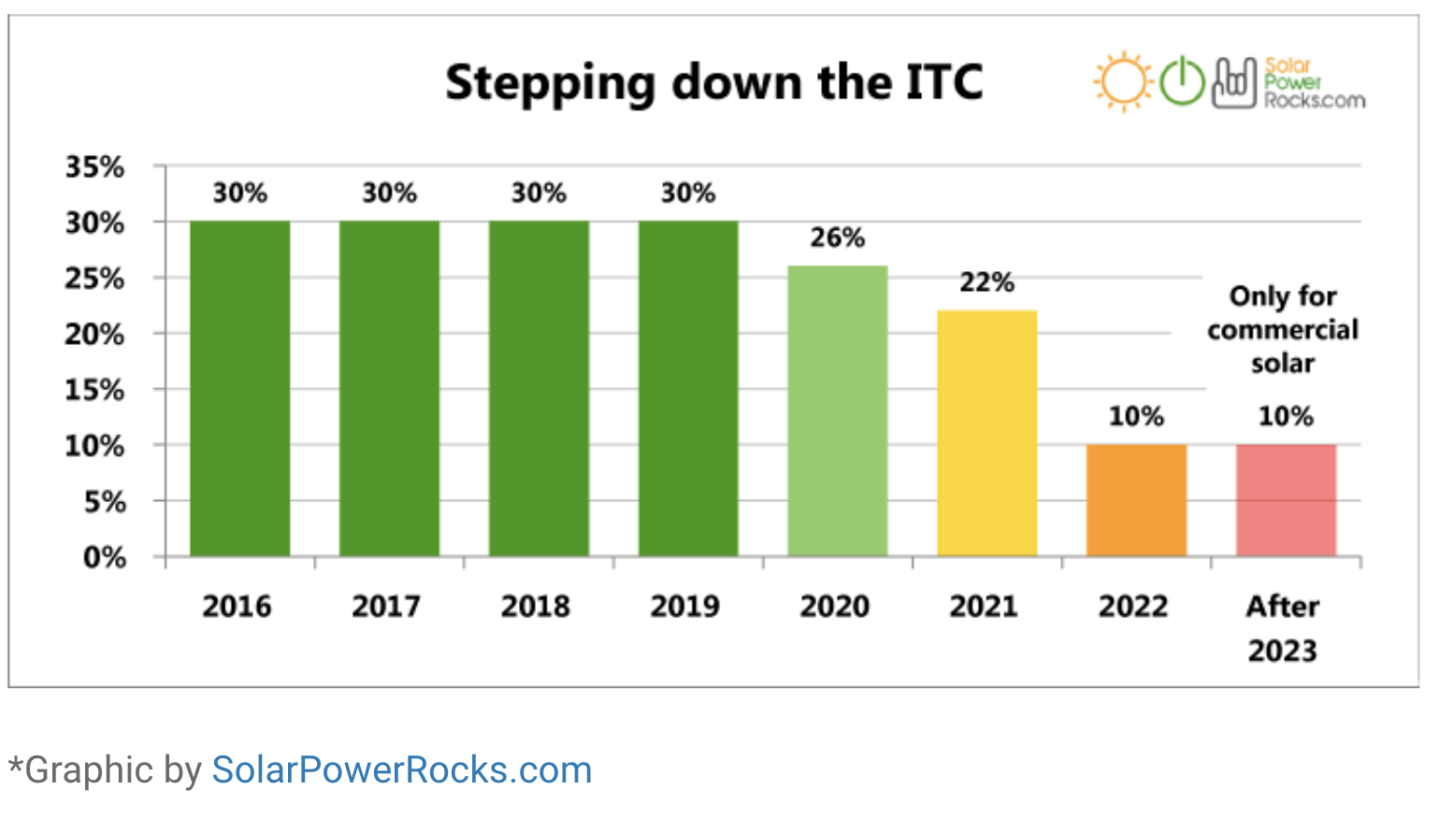

2019 is the final year of the 30% ITC. After 2019, it will be reduced to 26%. The percentage decreases year after year. In 2020, it will be 22%, and 10% in 2022, according to the U.S. Department of Energy.

According to Civic Solar, the imminent ITC step-down will “incentivize future system owners to act quickly in order to take advantage of the highest possible tax credit.” Business owners need to secure contracts with solar installation companies to maximize their ROI.

EnergyLink is one of the few companies in the to country provide both the energy construction and financial assistant services for their clients. If you are interested in installing solar energy for your facilities, click here to contact our engineers to learn more about it.